From Ratha Ra, Regional Project Support Team Coordinator

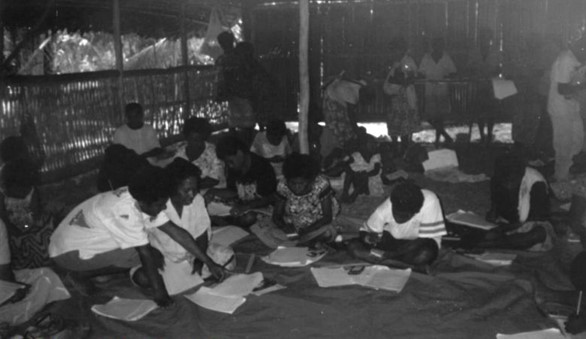

While most people are spending time with their family after work, our CUFA Timor-Leste staff are doing the opposite, giving up to 75% of their spare time teaching, training and supporting the community in financial literacy, enterprise skills, smart savings habits and other skills needed to form a credit union/self help group.

And the progress has been remarkable: since 2012, no fewer than 13 credit unions have been created within three sub-districts in Timor-Leste. With a policy of inclusion for all, the Timor-Leste team have encouraged communities to come together in order to drive positive change and the chance to be free from poverty.

Seeing such a vast improvement in living standards, economic growth and collaboration in such a short space of time not only inspired the team to continue with their work, but to ask themselves what more they could do.

“We teach, we learn, and we practise”

“We teach people to save and form a credit union in order to help themselves. How about us?” asked Martino Soares, a former CUFA credit union outreach project officer.“Why don’t we think about saving as a small group in order to help our staff?”

That question led to the genesis of a small savings group which opened in CUFA’s Timor-Leste office in 2012 with just five members. As membership and capital grew, this small savings group soon transformed into an official credit union; Falira Credit Union. It was registered under Federasaun Hanai Malu in Dili, Timor-Leste, on 28 February 2014.

Falira means “Your future is in your hands”

Over the past four years, there has been a 620% growth in membership – from five members to 36 – with USD$36,000 savings capital. At every annual general meeting, they brainstormed ideas to improve and promote more membership within the Dili community; now a number of non-CUFA staff are also members.

For an example of the extraordinary service they now provide for their members, you only have to compare Falira’s loan interest rate of just 3% per month with 18% from the bank and 15% from a money lender.

“The purpose of Falira credit union is to help the CUFA Timor-Leste staff,” explained Henrique Joaquim Alexio, president of Falira Credit Union and also a VEI project coordinator for CUFA Timor-Leste. “They can save for their family’s future and look after their family’s needs by accessing loans with low interest rates.”

Delius Constantino, CUFA Timor-Leste security guard (pictured above) and also a loan officer in Falira Credit Union, said: “My savings are USD $485 and I am so happy to see my money is growing.”

“After moving house to live with my wife, it is 20km away from CUFA office, It was so difficult to reach the office on time by bus. I decided to ask for a USD $1000 loan in 2013 from Falira Credit Union to buy a new motorbike. Now I can ride to office on time.” CUFA Timor-Leste staff have not only saved but they have also accessed low interest rate loans for purchases like land, a car, a motor bike, building a new house and sending children to university.

“I asked for a loan of $3,000 in 2015 to purchase land in Dili for my family,” CUFA CUD Project Officer Celestino Rangel explained with a happy smile.

“It is so much of a struggle to ask for a loan from the bank or money lender while they need so many documents and with such high interest rates. I am really happy to be a member of Falira Credit Union.”

The Falira Credit Union is planning to promote more membership growth in future to ensure they can continue to provide loans to their members.

“I cannot believe that there is a small credit union in the CUFA office. This is a really good example to promote a habit of savings and assist our staff by providing a loan for their needs,” Antonio Do Rosario, CUFA Timor-Leste country program manager said.

“I will surely join the Falira Credit Union in March 2016 in order to save for my children and family needs in the future,” he added

POSTSCRIPT: The first challenge Falira credit union faced was finding an office space in which to operate daily. CUFA has kindly provided a special room for them to run their business – thank you.

A credit union is a member-owned financial cooperative, democratically controlled by its members, and operated for the purpose of promoting thrift, providing credit at competitive rates, and providing other financial services to its members.

What does your credit union mean to you?